Individual Investor & Trader

The ATO has defined three classes for Australian tax reporting into three broad categories of buyers and sellers of Cryptocurrencies, each type attracts different reporting obligations & may have vastly different income tax consequences.

The categories of reporting are:

- Investor

- Trader

- Personal User

Am I a Cryptocurrency Investor?

A Cryptocurrency Investor will usually buy Cryptocurrency for a longer period of time and invest in a Cryptocurrency for its long term growth. Investors are usually deemed to be investing into a Cryptocurrency on Capital account, whereby the transactions of buying and selling cryptocurrency fall into the taxation rulings of Capital Gains Tax. Investors are usually not seen as running a business, but merely investing for the appreciation of the asset.

If you are deemed to be a Cryptocurrency Investor you will need to report your Capital Gains or Losses as a Capital Gains Tax (CGT) in your income tax return.

Under Capital Gains Tax, the sale price that you receive is called the ‘capital proceeds’ and the purchase price is called the ‘cost base’. You make a capital gain if:

- the capital proceeds are greater than the cost base or

- You make a capital loss if the capital proceeds are less than the cost base

As you are not operating a business, expenses such as trading fees will be attributed directly to the cost base or reduce your sale proceeds, thereby reducing your capital gain or increasing your capital loss.

The basic formula is as follows:

If the transactions:

Capital Proceeds > Cost Base = Capital Gain

Cost Base > Capital Proceeds = Capital Loss

Where the:

Capital Gains > Capital Losses = Net Capital Gain

Capital Losses > Capital Gains = Carried Forward Losses

Where the transaction results in a Net Capital Gain, this needs to be reported in your income tax return as income.

Where the transaction results in a Carried Forward Loss then you will also need to report this on your income tax return, which can be used in the following year and/or future years to reduce your future capital gains.

It is important to note that capital losses cannot be offset against other types of income, such as salary and wages, dividends or rental income, unless it is directly reducing a Capital Gain.

If you do hold your Cryptocurrency for longer than 12 months then you would be entitled to a 50% general discount on the Capital Gain you have made, which effectively will half the amount of income that needs to be declared in the income tax return.

When calculating the gains of your Cryptocurrency the ATO allows you to apply the First In First Out (FIFO) method to calculate your cost base. By using this method you must use the oldest purchase of the specific Cryptocurrency you are purchasing first against the proceeds of your sale.

Below we outline an example of a Cryptocurrency Investor and how they would work out their capital gain or loss for the financial year.

Investor – Tax example

Dean goes to see his Accountant and after discussing his personal circumstances, is deemed that he meets the criteria to be treated as a Cryptocurrency Investor for the 2018 financial year

On the 1 of January 2017 he purchased 10 Bitcoins. While Holding his Bitcoins he felt that his investment would not appreciate any longer so sold 5 Bitcoins for 50 Ethereum on the 2 January 2018.

Dean sold 25 Ethereum on the 20 June 2018, so he could pay for a holiday

Dean did not have any other income for the 2018 financial year, nor did he have any capital losses from prior years.

Facts of the transactions are as follows:

| Date | Transaction Type | Coin | Amount of Coins | Value per 1 coin (at time of purchase or sale) | Total Value (AUD) | |||

| 01/01/2017 | Purchase | BTC | 10 | $ 1,000 | $ 10,000 | |||

| 02/01/2018 | Sale | BTC | 5 | $ 10,000 | $ 50,000 | |||

| 02/01/2018 | Purchase | ETH | 50 | $ 1,000 | $ 50,000 | |||

| 20/06/2018 | Sale | ETH | 25 | $ 1,500 | $ 37,500 | |||

| Capital Gains Event 1 – Sale of BTC | ||||||||

| Capital Proceeds | $ 50,000 | |||||||

| Less Cost Base | $ 5,000 | |||||||

| Gross Capital Gain | $ 45,000 | |||||||

| Less 50% discount | $ 22,500 | held for longer than 12 months | ||||||

| Net Capital Gain | $ 22,500 | |||||||

| Capital Gains Event 2 – Sale of ETH | ||||||||

| Capital Proceeds | $ 37,500 | |||||||

| Less Cost Base | $ 25,000 | |||||||

| Gross Capital Gain | $ 12,500 | |||||||

| Less 50% discount | N/A | not held for longer than 12 months | ||||||

| Net Capital Gain | $ 12,500 | |||||||

| Total Net Capital Gains | $ 35,000 | |||||||

| Note that Dean still owns | ||||||||

| – 5 BTC | ||||||||

| – 25 ETH | ||||||||

|

Dean does not need to include the remaining BTC or ETH on Hand in his tax return because they remain unsold. The $35,000 needs to be reported on Dean’s Income Tax Return for the 2018 financial year.

|

||||||||

Cryptocurrency Trader

In light of the Cryptocurrency Boom; specifically in the 2017 and 2018 financial years, there has been a large amount of Investors who are eager to learn how to trade and are beginning to trade Cryptocurrency on a regular basis.

Traders also need to aware of the tax consequences that their actions may cause when it comes to preparing their income tax return. It has come to light that many Cryptocurrency investors will fall within this category without understanding the tax implications that may arise.

We have listed ATO guidance regarding Cryptocurrency trading parameters and how this may affect you when it comes to declaring your income.

The ATO issued a Tax Ruling 97/11 which provides a detailed list of factors that can be applied to determine if you are operating a business as a trader:

- Whether the activity has a significant commercial purpose or character; this indicator comprises many aspects of the other indicators

- Whether the taxpayer has more than just an intention to engage in business

- Whether the taxpayer has a purpose of profit as well as a prospect of profit from the activity

- Whether there is repetition and regularity of the activity;

- Whether the activity is of the same kind and carried on in a similar manner to that of the ordinary trade in that line of business

- Whether the activity is planned, organised and carried on in a businesslike manner such that it is directed at making a profit

- The size, scale and permanency of the activity

- Whether the activity is better described as a hobby, a form of recreation or a sporting activity.

Australian Taxation Office – https://www.ato.gov.au/law/view/document?DocID=TXR/TR9711/NAT/ATO/00001

You must also be mindful that one factor in itself is not conclusive, the ATO encourages you to review all of the factors and consider each factor in combination with the others.

A trading business is generally reported similar to a business who sells goods, where the sales of Cryptocurrencies are recorded as assessable income and purchases are treated as cost of sales.

To ensure that you correctly account for your Cryptocurrency stock on hand at the 30th of June, you should conduct a ‘stocktake’ of your Cryptocurrency by adding up amount of each Cryptocurrency you own in AUD on that date.

As a business, you may be entitled to claim additional income tax deductions for other business-related costs that relate to your trading activities. These may include

- Trading Fees;

- Internet and home office costs;

- Mobile phone and telephone;

- Subscriptions;

- Trading software;

- Accounting Fees or other professional fees;

- Depreciation on assets

Is it possible to be an Investor and a Trader?

Yes, you may choose to have a long term investing portfolio and also a trading portfolio of Cryptocurrencies. You will need to clearly demonstrate that both portfolios have different intentions to ensure that different tax treatment.

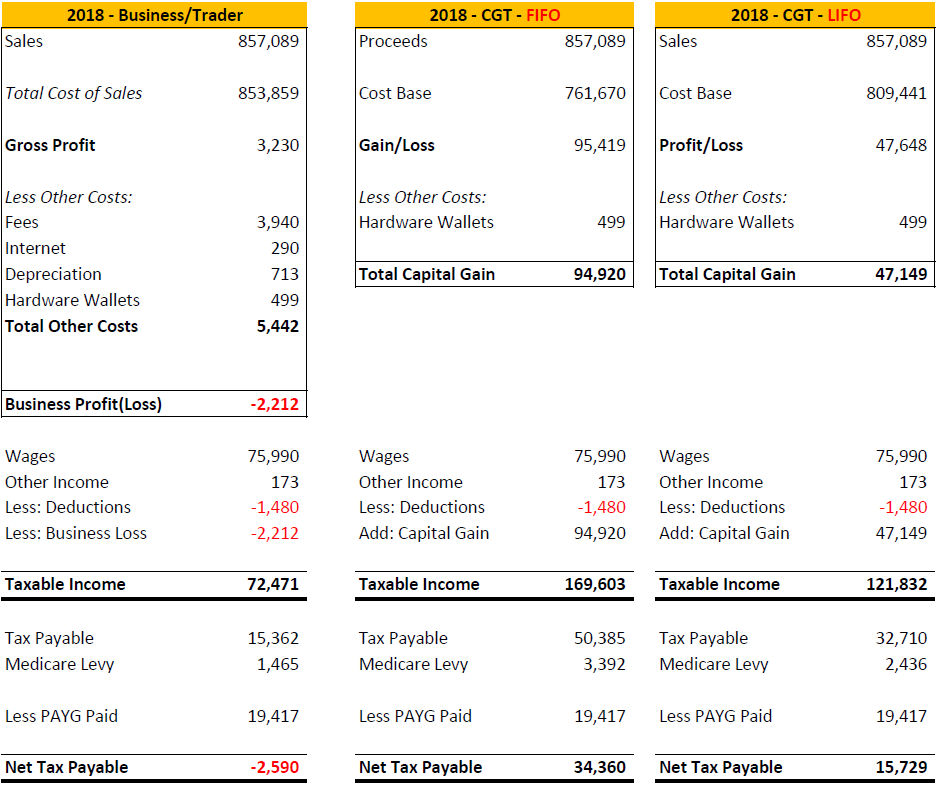

What is the difference on calculating a Trader and Investors profit/loss at the end of the financial year?